Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License .

6: Determine and Dispose of Underapplied or Overapplied Overhead

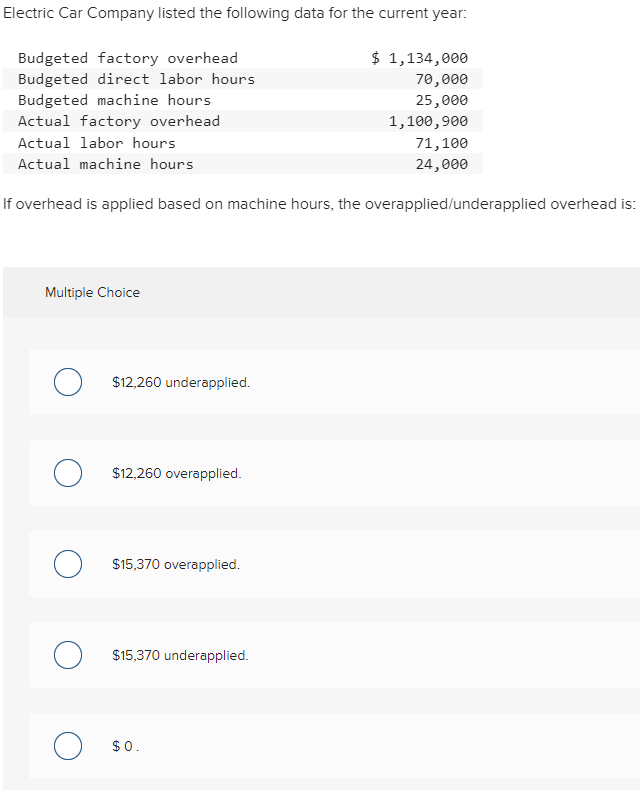

Actual overhead costs are found through company receipts for how much overhead costs. In an academic setting, problems from textbooks will often provide actual overhead costs per hour. If actual overhead costs per hour are given, then multiply those costs per hour by the number of hours worked.

Example of Overapplied Overhead

- On average, however, the amount of overhead applied should approximately match the actual amount of overhead incurred.

- As the company goes about its business making products, its accountants will charge manufacturing overhead expenses to inventory based on the number of machine hours used in production and the estimated rate.

- Carbonic Corporation uses an overhead application rate that resulted in $15,000 of excess overhead being charged to produced units during its March reporting period.

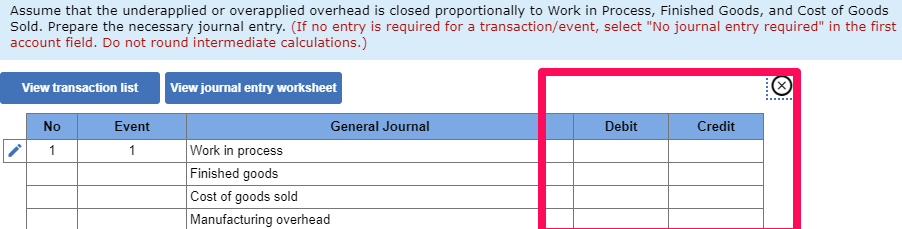

When overhead has been overapplied, the proper accounting is to debit the manufacturing overhead cost pool and credit the cost of goods sold in the amount of the overapplication. Doing so results in the actual amount of overhead incurred being charged through the cost of goods sold. In this case, the manufacturing overhead is underapplied by $1,000 ($11,000 – $10,000) as the applied overhead accounting principles explained: how they work gaap ifrs cost is $1,000 less than the actual overhead cost that has occurred during the accounting period. This journal entry is the opposite of the overapplied overhead as the remaining balance of the manufacturing overhead, in this case, will be on the debit side at the end of the accounting period instead. Hence, we need to credit the manufacturing overhead account instead to zero it out.

What is Overapplied Overhead?

Overapplied overhead is the result of the manufacturing overhead costs that are applied to the production process is more than the actual overhead cost that actually incurs during the accounting period. Underapplied overhead occurs when a business doesn’t budget enough for its overhead costs. This means the budgeted amount is less than the amount the business actually spends on its operations. For example, when a company incurs $150,000 in overhead after budgeting only $100,000, it has an underapplied overhead of $50,000. This is referred to as an unfavorable variance because it means that the budgeted costs were lower than actual costs.

Sometimes the estimate is more than the actual amount and sometimes it’s less than the actual amount. Overapplied overhead happens when the estimated overhead that was allocated to jobs during the period is actually more than the actual overhead costs that were incurred during the production process. In a sense, the production managers came in “under budget” and achieved a lower overhead than the cost accountants estimated. In this case, XYZ Corp. will need to make an adjustment to its accounting records to account for the overapplied overhead.

Advanced software tools like SAP and Oracle can facilitate this process by providing real-time data and analytics, enabling more informed decision-making. For a company engaged in manufacturing, determining the value of inventory can be complicated. The company must account for the raw materials used in making its products, the direct labor required and any manufacturing overhead. If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied. If, at the end of the term, there is a credit balance in manufacturing overhead, more overhead was applied to jobs than was actually incurred.

In some periods, either the number of units produced will be greater than expected, or actual factory overhead costs will be lower than expected. In these situations, the use of a standard overhead rate will result in overapplied overhead. For example, on December 31, the company ABC which is a manufacturing company finds out that it has incurred the actual overhead cost of $9,500 during the accounting period. However, the manufacturing overhead costs that it has applied to the production based on the predetermined standard rate is $10,000 for the period. Sometimes, the actual overhead costs for a given period might be lower than what was estimated and allocated to the cost of goods or services, resulting in what is known as overapplied overhead. Overapplied overhead is manufacturing overhead applied to products that is greater than the actual overhead cost incurred.

Now the machine shop has to book an additional $600 of overhead expense because the original estimate what under applied. In this book, we assume companies transferoverhead balances to Cost of Goods Sold. We leave the morecomplicated procedure of allocating overhead balances to inventoryaccounts to textbooks on cost accounting. If not adjusted, the overapplied amount can lead to an overstatement of net income. This can have tax implications, as higher reported earnings may result in a larger tax liability.